Research

Solutions

Unlock deeper insights into your portfolio with a suite of quant research tools designed to clarify performance drivers, uncover factor exposures, and benchmark your strategies within the global QIS landscape. Build, test, and analyse with confidence.

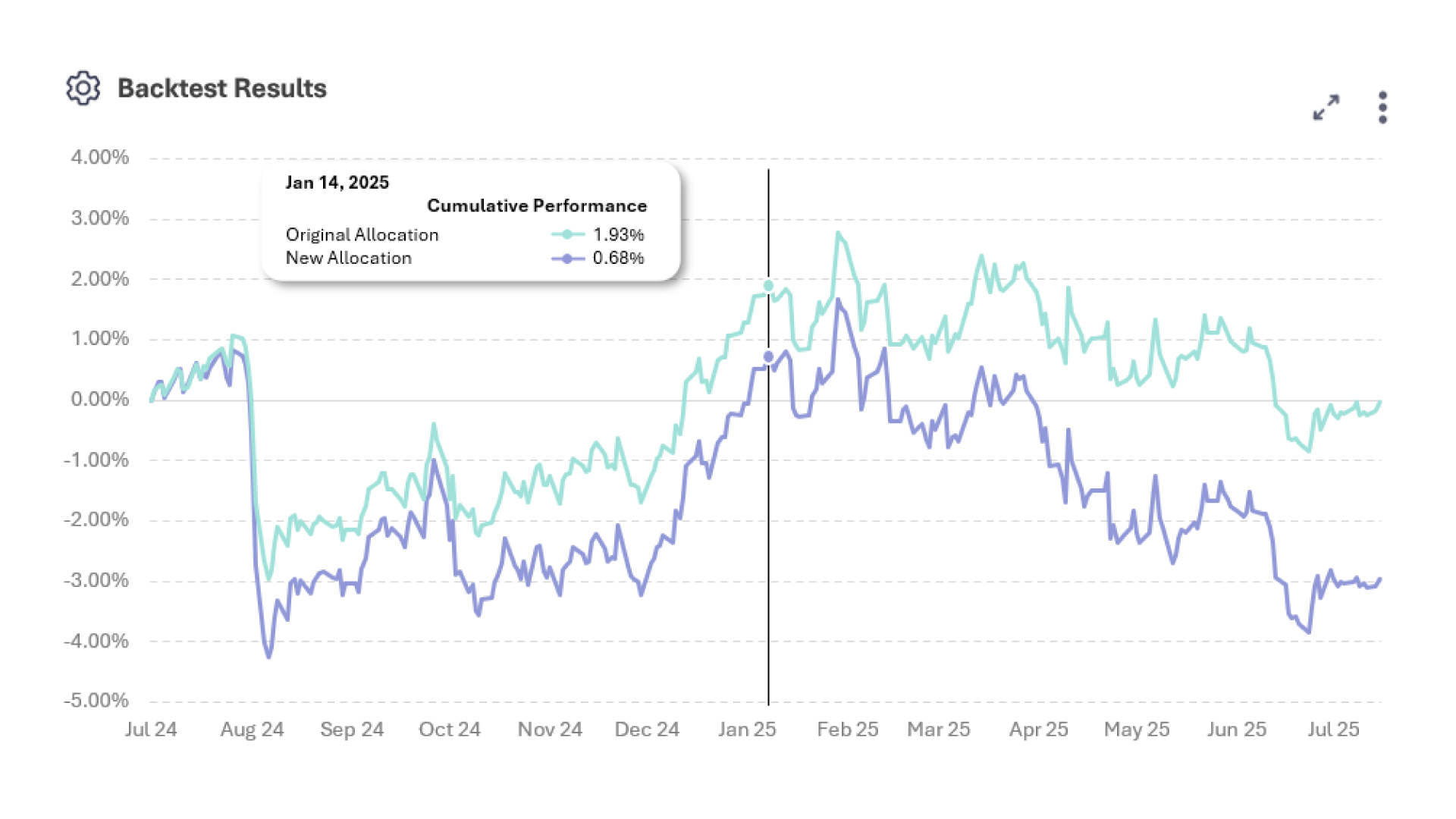

Portfolio Construction

Design, test, and refine tailored multi-asset portfolios using risk premia strategies, market indices, or your own proprietary time series. Build and optimize allocations through a range of rebalancing methodologies while leveraging comprehensive backtesting to evaluate performance and market sensitivities across historical periods. With access to an extensive universe of funds and ETFs through Lipper, the platform empowers you to enhance diversification, improve asset selection, and fine-tune portfolio efficiency with data-driven confidence.

PCA Analysis

Apply Principal Component Analysis to portfolios, QIS indices, market benchmarks, custom time series, and thousands of funds and ETFs from the Lipper universe. By decomposing returns into their principal components, the tool quantifies how much variance is driven by major factors versus orthogonal or idiosyncratic effects. This helps investors assess factor concentration, diversification quality, style drift, and structural exposures with statistical precision.

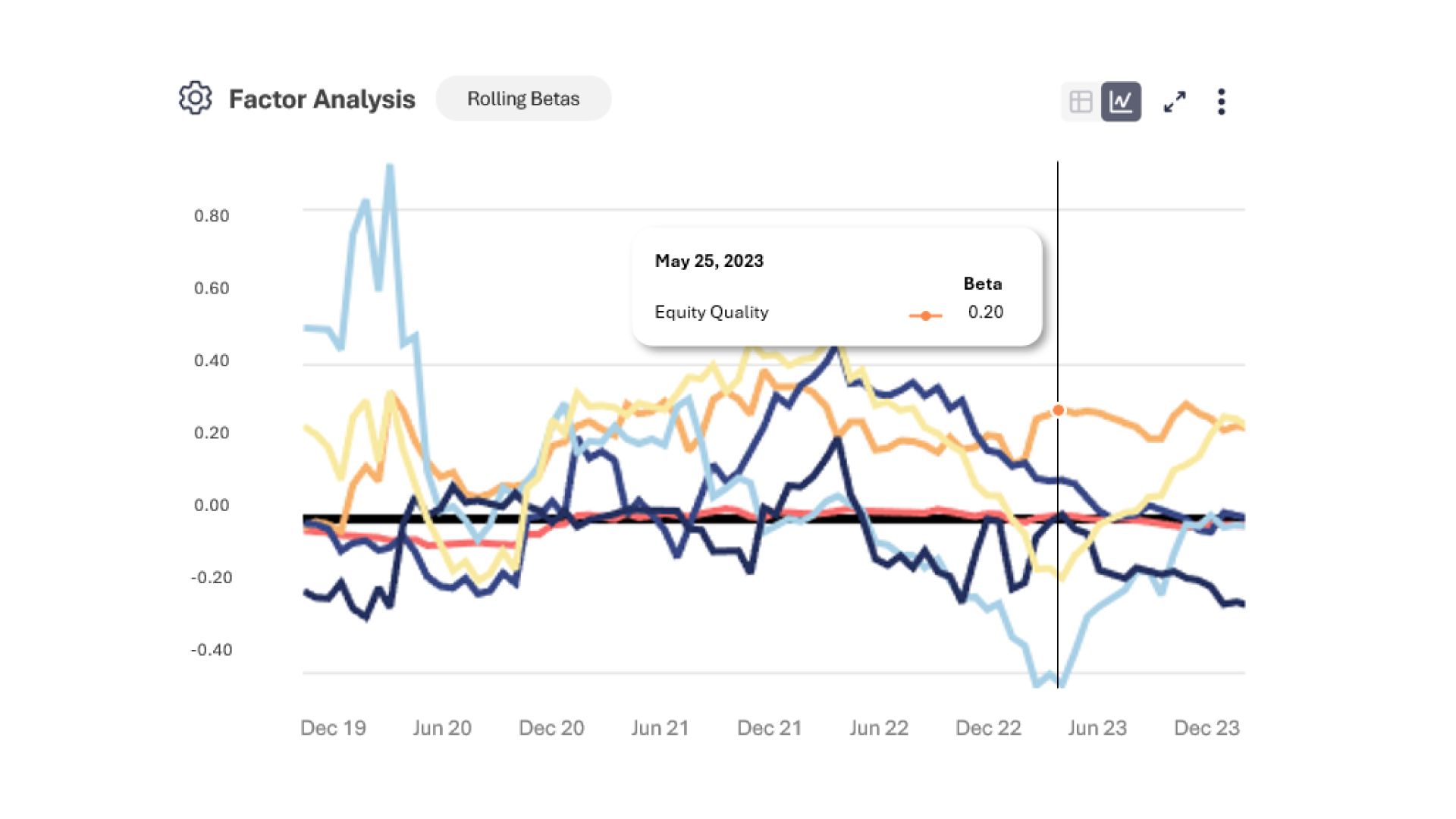

Factor Analysis

Uncover the true drivers of return and risk by running regressions on any dataset—QIS indices, portfolios, market benchmarks, mutual funds, ETFs from Lipper, or your own uploaded time series. Analyse exposure to traditional market betas or style factors across equities, rates, credit, commodities, FX, and cross-asset premia. Choose between a track-record model, which computes rolling betas and provides intuitive return decomposition, or a position-based model that infers factor sensitivities directly from portfolio holdings. This dual-approach framework offers a complete, transparent view of strategy behaviour and performance drivers.

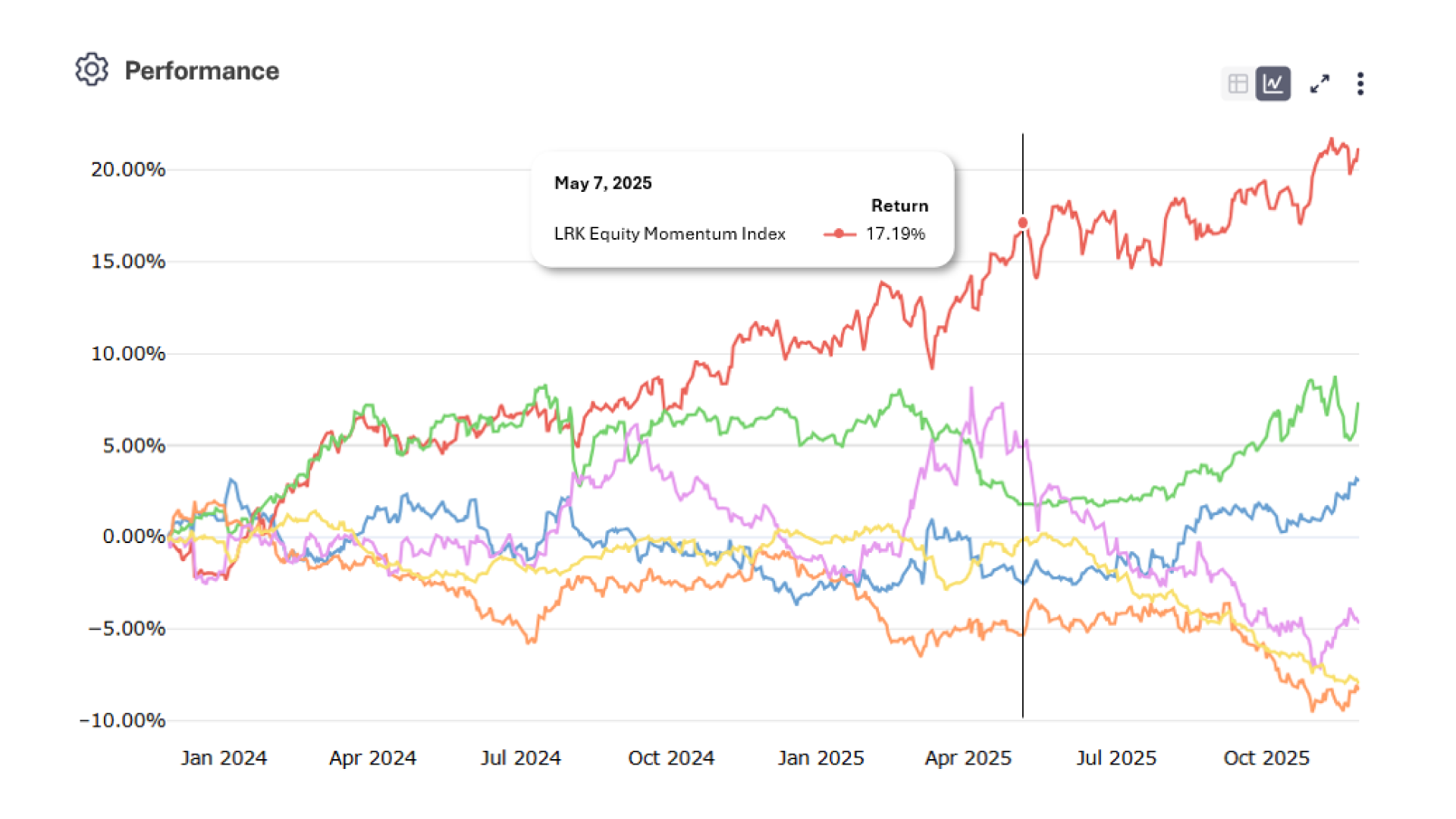

LumRisk Indices

LumRisk’s ARP indices give you a clear, unbiased view of the global QIS landscape. Drawing on over 5,000 strategies from 17 leading banks, our benchmarks allow you to compare performance, understand style exposures, and identify structural trends across asset classes and implementations. Powered by a rigorous classification framework enhanced with machine learning, these indices provide an essential reference point for allocation decisions, due diligence, and ongoing portfolio monitoring.